are hearing aids tax deductible in 2020

Deducting the cost of hearing aids from your taxable income. With 2021 taxes already being filed we explore what you need to know.

Hearing Aid Blog Hearing Loss Articles Earpros

The IRS allows you to deduct money spent on preventive care treatment surgery dental and vision care visits to psychologists and psychiatrists prescription medications and appliances such as glasses contacts false teeth hearing aids and orthotics to travel for qualified medical treatment.

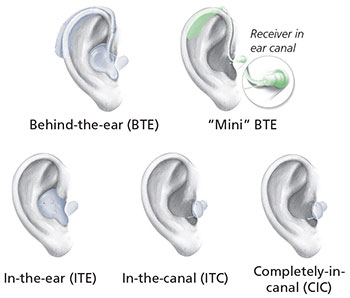

. They come under the category of medical expenses. In many cases hearing aids are tax-deductible. Hearing aids on average cost between about 1000 and 4000 according to a report from Consumer Affairs.

If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct expenses you paid that year for medical and dental care for yourself your spouse and your dependents. Hearing aids or personal assistive listening devices including repairs and batteries. For example you would use this line if you purchased hearing aids for your spouse at some point in 2020.

Univ faculty NOT INTUIT EMPLOYEE. Insured may choose a more expensive hearing aid and pay the. Depending on your situation you may be able to pay for hearing aids using a Health Savings Account HSA or a Flexible Spending Arrangement FSA.

John properly filed his 2020 income tax return. If you file electronically save all your receipts together in case the cra requests. As of mid-2020 there are no tax credits for hearing aids.

For 2020 taxes the medical travel rate is 17 cents per mile down from 20 cents per mile in 2019. You may deduct only the amount of your total medical expenses that exceed 7. Thus for the employee the father as necessary business expense and ordinarily used by any hearing impaired individual the hearing aids would have been prior to TCJA deductible but now not until after 2025.

Contents hide Cosmetic surgeries are tax deductible. The cost of her health insurance premiums in 2020 is 8700. If you drive you can claim the standard medical expense mileage rate which is 18 cents per mile for the 2018 tax year up from 17 cents for 2017.

Keep in mind due to tax cuts and jobs act tax reform the 75 threshold applies to tax years 2017 and 2018. Deducting the cost of hearing aids from your taxable income can lower the amount you pay for hearing aids. March 16 2020 311 PM Only medically required equipment is eligible to be deducted.

The rates are set at 17 cents per mile for tax year 2020 and. If you itemize your medical deductions on your federal income tax hearing aids are tax-deductible. Tax offsets are means-tested for people on a higher income.

Lines 33099 and 33199 Eligible medical expenses you can claim on your tax return. You would claim the amount in this section to get the proper tax-deductible related to hearing aids. At Least Hearing Aids Are Partly Tax Deductible According to Health Hearing and other sources we consulted the following applies to hearing aid deductibles for the 2020 tax season.

He died in 2021 with unpaid medical expenses of 1500 from 2020 and 1800 in 2021. While this puts hearing aids beyond many peoples typical monthly budget there are actually quite a few ways that these costs can be controlled. What Medical Expenses Are Tax Deductible 2020.

The standard deductions for 2019 are. At Least Hearing Aids Are Partly Tax Deductible According to Health Hearing and other sources we consulted the following applies to hearing aid deductibles for the 2020 tax season. By Joe Griffith Published July 1 2020 With filing deadlines quickly approaching you should be gathering all the information and receipts for your deductions.

Hearing aids batteries maintenance costs and repairs are all deductible. With both the HSA and FSA there is no deduction threshold. In the US reimbursement is allowed from the IRS for preventative treatment surgery dental or vision care office visits with psychologists and psychiatrists prescriptions including eye drops glasses contacts false teeth and hearing aids and travel for purposes such as qualified medical care.

In january 2017 s48 the hearing aid assistance tax credit act was introduced to congress. They can only deduct the amount of their medical and dental expenses that is greater than 75 of their adjusted gross income. Line 33099 Medical expenses for self spouse or common-law partner and your dependant children born in 2003 or later.

If you use the standard deduction you cannot deduct any medical expenses. Scruffy Curmudgeon--PFFM IAFF Locals 71830 retired firefightermedic. If the expenses are paid within the 1-year period his survivor or personal representative can file an amended return for 2020 claiming a deduction based on the 1500 medical expenses.

Claiming deductions credits and expenses. Personal income tax. Income tax rebate for hearing aids The good news is that if you have an income and pay income tax you can claim a tax offset for any out-of-pocket costs on your hearing aids.

All the cash contributed to the HSA or FSA reduces your taxable income ie is considered pre-tax dollars. As of mid-2020 there are no tax credits for hearing aids. Cosmetic surgeries are tax deductible.

Parking and tolls are also deductible if you. Insurance costs including premiums co-insurance and co-pays from already-taxed income. Single - 12200 add 1650 if age 65 or older add.

502 Medical and Dental Expenses. Summary The IRS is the largest accounting and tax-collection organization in the world with in excess of 480 forms posted on their website and more employees than the FBI. Non-deductible expenses in other words are the disbursements that cannot be considered for the computation of the net profit before taxes corporate tax or income tax for example.

Braille books are also deductible. In many cases hearing aids are tax-deductible. You can only deduct medical expenses if you itemize your deductions.

What Medical Expenses Are Tax-Deductible 2020. Subsidies for retired hearing aids. Heart monitoring devices including repairs and batteries prescription needed.

One of those deductions that you may not think of is your hearing aids.

Over The Counter Hearing Aid Regulations Jacksonville Speech And Hearing Center

Costco Hearing Aids 5 Things To Know Before You Buy

Are Hearing Aids Tax Deductible Anderson Audiology

How To Pay For Hearing Aids Davenport Audiology Hearing Aid Center

![]()

Are Hearing Aids Tax Deductible Earpros Ca

How To Pay For Hearing Aids Retirement Living 2022

Are Over The Counter Hearing Aids On The Way Lsh

Medicaid Covers Hearing Aids Healthcare Counts

What You Should Know About Medicaid Coverage For Hearing Aids Plus Alternatives Updated For 2022 Aginginplace Org

What You Should Know About Medicaid Coverage For Hearing Aids Plus Alternatives Updated For 2022 Aginginplace Org

![]()

Hearing Aid Insurance Why Insurance Companies Don T Pay

What You Can Do With Your Old Hearing Aids Lexie Hearing

Tax Breaks For Hearing Aids Sound Hearing Care

Community Hearing Aid Programs Jacksonville Speech And Hearing Center

How Much Of The Cost Of Hearing Aids Does Medicare Cover Goodrx

Does Medicare Cover Hearing Aids Qrius